Section 321 of the Trade Act of 1974 offers a streamlined process for customs clearance of low-value items imported into the United States. This provision allows shipments valued at $800 or less to enter the country without the need for formal entry, expediting delivery and reducing costs for businesses and consumers alike. Understanding the benefits and requirements of Section 321 can greatly enhance the efficiency of logistics operations.

The significance of Section 321 Customs Clearance extends beyond just cost savings; it also represents an essential policy for encouraging e-commerce and small business growth. By simplifying the customs process, it opens the door for smaller retailers to compete more effectively in the global marketplace. Readers interested in international trade and shipping will find valuable insights into how this section can positively impact their operations.

Navigating customs can often be complex and frustrating, but Section 321 provides a straightforward solution for qualifying shipments. With the proper knowledge and preparation, businesses can take full advantage of this exemption, ensuring quick and hassle-free delivery of their products.

Overview of Section 321

Section 321 provides a mechanism for the expedited clearance of low-value shipments entering the United States. This section is key for importers aiming to streamline their customs processes and minimize delays.

Eligibility Criteria

To qualify for Section 321, shipments must meet specific requirements. The value of the goods should not exceed $800 per person per day. Additionally, the shipment must be for personal use and not for resale or commercial purposes.

Certain items, like alcohol, tobacco, and some hazardous materials, are excluded from this provision. Importers must ensure that the shipment complies with all applicable regulations and can provide necessary documentation, including proofs of value and origin.

Benefits of Section 321

The advantages of utilizing Section 321 are significant. It enables faster clearance of eligible shipments, helping businesses reduce shipping times. This can enhance customer satisfaction and improve operational efficiency.

Moreover, it lowers customs duties and fees since low-value shipments often incur fewer charges. The simplified paperwork reduces the administrative burden on importers, allowing them to focus more on their core operations. As a result, Section 321 provides an attractive option for efficient importation of low-value goods.

Customs Clearance Process Under Section 321

The Customs Clearance Process under Section 321 is designed to streamline the importation of low-value goods. This process allows for expedited customs clearance, making it beneficial for both importers and consumers.

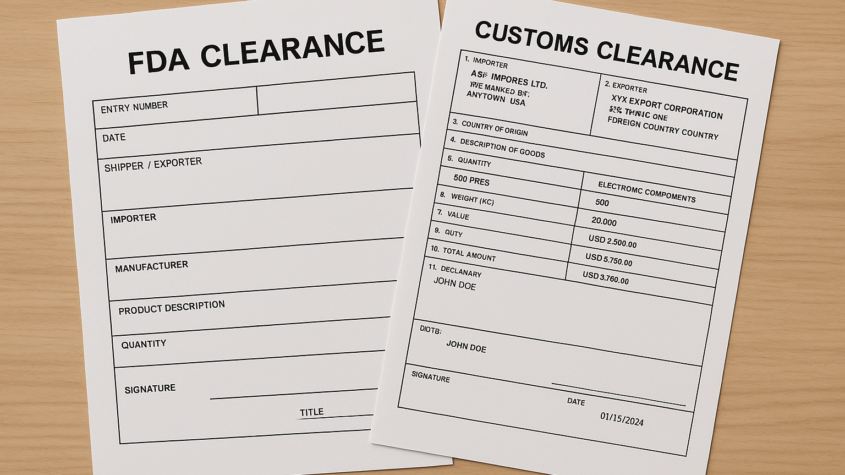

Documentation Requirements

Importers must submit specific documentation to utilize Section 321. This includes:

- A completed U.S. Customs and Border Protection (CBP) entry form.

- An invoice detailing the value and description of the goods.

- Evidence of compliance with any applicable regulations.

If the goods are valued at $800 or lower, extensive documentation may not be required. Importers must retain records for a minimum of five years to support their claims and ensure compliance with customs regulations.

Electronic Data Interchange Systems

CBP utilizes Electronic Data Interchange (EDI) systems to facilitate the Section 321 process. Importers can file entry data electronically, which provides advantages such as:

- Faster processing times.

- Reduced paperwork.

- Enhanced communication between CBP and the importer.

Effective use of EDI systems can reduce delays at the borders and streamline the overall customs clearance process, making efficient use of resources for both parties.

Exemptions and Limitations

Section 321 has specific exemptions and limitations that importers should be aware of. The primary exemption is for goods valued at $800 or less. Items that do not qualify include:

- Restricted or prohibited items.

- Goods subject to special tariffs or duties.

Importers should note that Section 321 is not applicable for shipments consolidating multiple items exceeding the $800 threshold. Understanding these limitations is crucial for compliance and to avoid fines or delays in the clearance process.

Rent Mini Excavator Near Me: Your Guide to Affordable Options and Local Availability

Renting a mini excavator can be a game changer for small construction projects, landscapin…